fidelity tax-free bond fund by state

Fidelity Tax-Free Bond has found its stride. The yield is calculated by dividing the net.

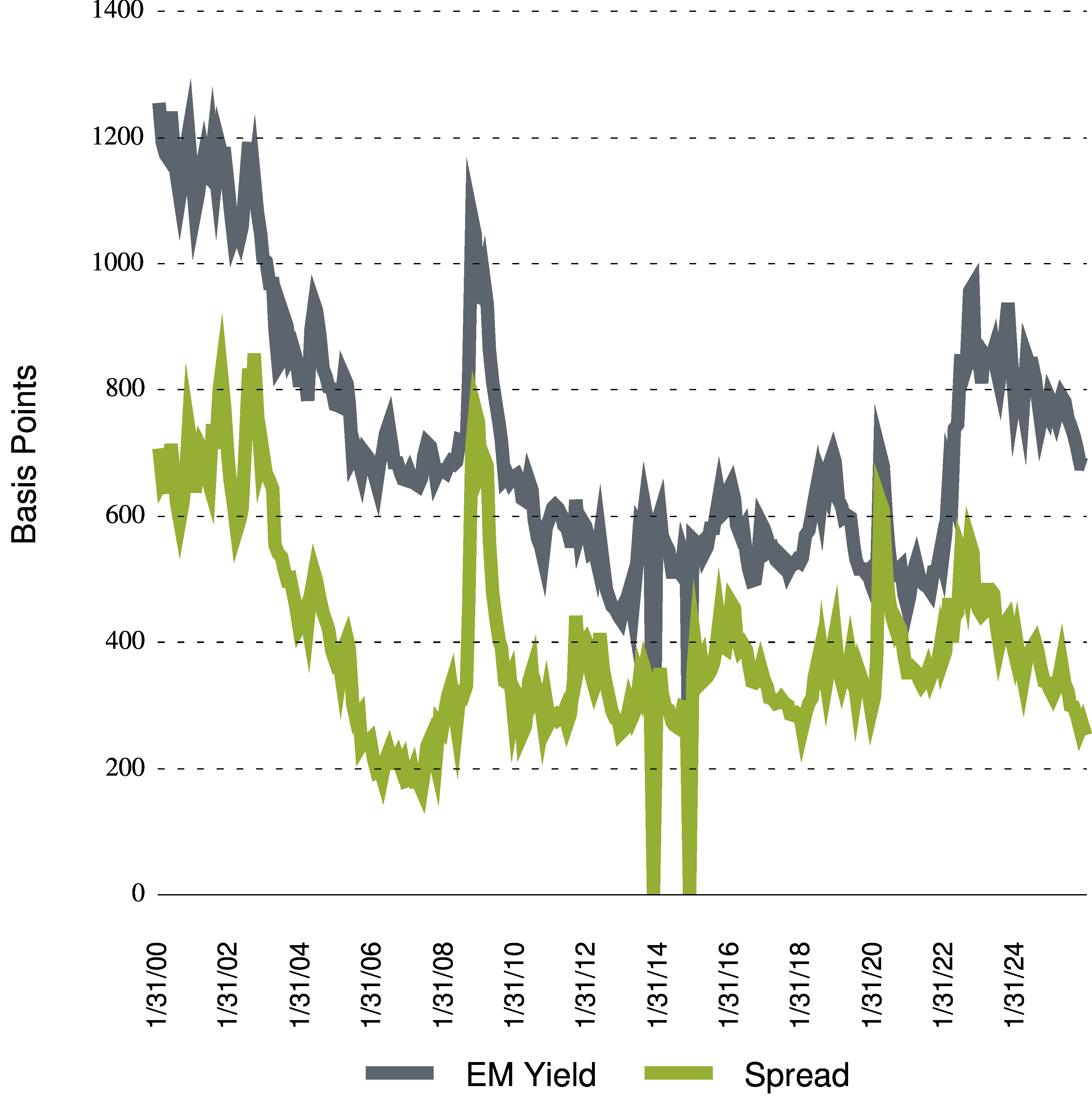

Fnmix Fidelity New Markets Income Fund Fidelity Investments

See Why California Municipal Bonds Are A Golden Investment Opportunity.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/pencil_chart-56a693f15f9b58b7d0e3acb4.jpg)

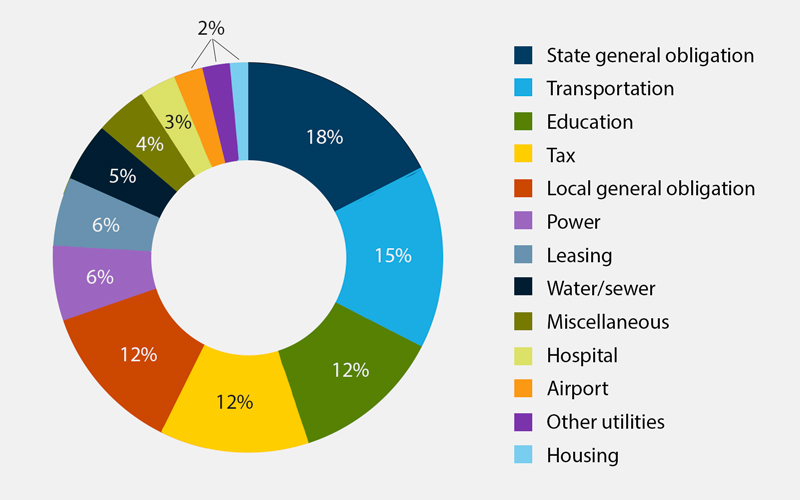

. Fidelity Tax-Free Bond FTABX. To lower risk these portfolios spread their assets across many states and sectors. Unique Structure Designed To Maximize After-Tax Returns.

The investment seeks a high level of current income exempt from federal income tax and Arizona personal income tax. Get quote details and summary for Fidelity Tax-Free Bond Fund FTABX. Before investing consider the funds investment objectives risks charges and expenses.

Stay up to date with the current NAV star rating asset. We Believe Diverse Perspectives and High-Conviction Investing Can Produce Better Results. Normally investing at least 80 of assets in investment-grade municipal securities whose interest is exempt from federal income tax.

Ad Invest in some of todays most innovative companies all in one exchange-traded fund ETF. Best tax-free municipal bond. This guide may help you avoid regret from making certain financial decisions.

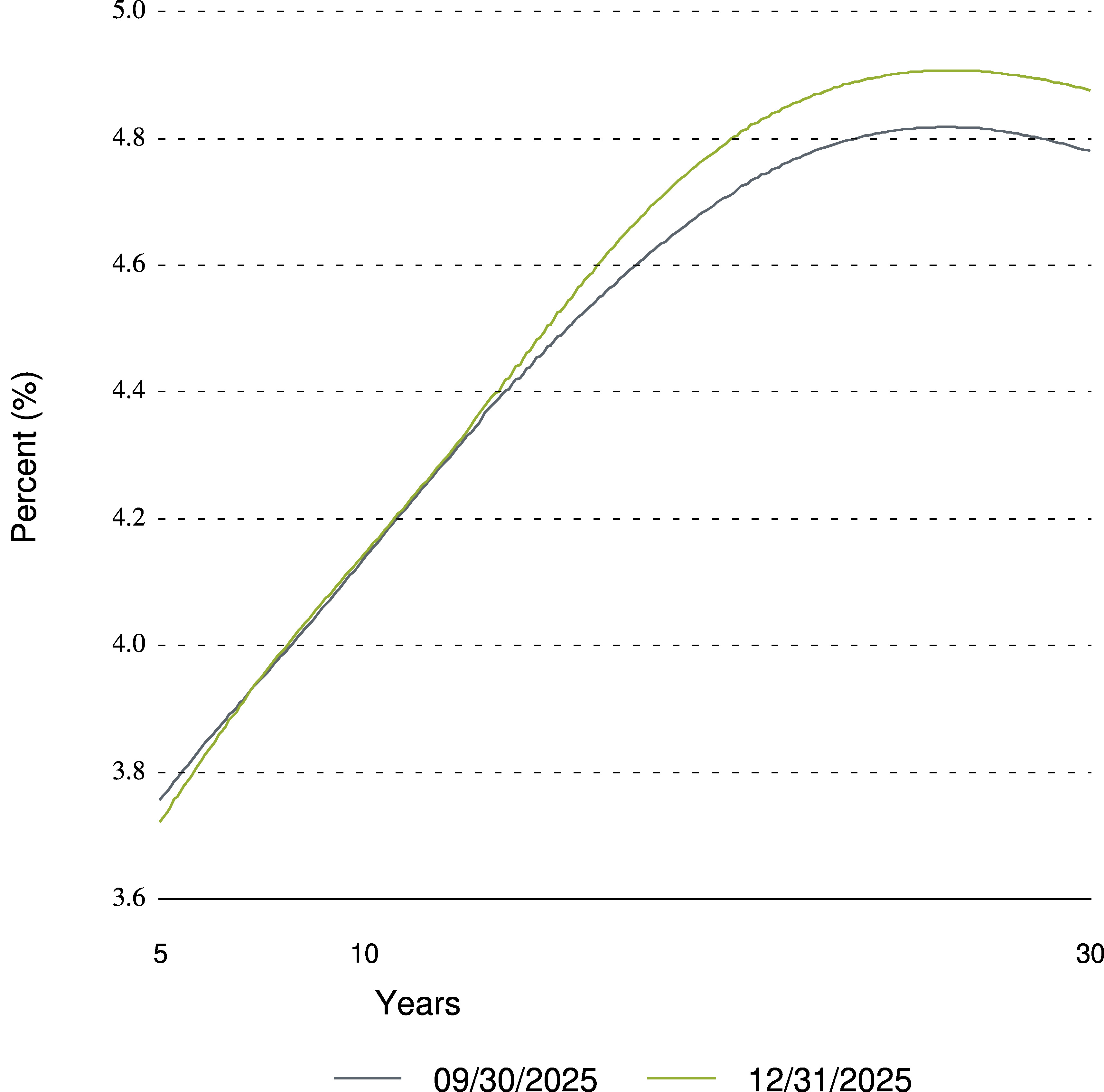

Fidelity Fund Data and Rates Tables. NY STATE URBAN DEV. Vanguard High Yield Tax Exempt Fund VWAHX.

Fidelity Tax Free Bond Fund. Learn more about mutual funds at. Ad If you have a 500000 portfolio get this must-read guide by Fisher Investments.

Ad Invests Across Municipal Bonds And Taxable Bonds. Fidelity Tax-Free Bond Fund is a diversified national municipal bond strategy investing in general obligation and revenue-backed municipal securities across the yield curve. Analyze the Fund Fidelity Tax-Free Bond Fund having Symbol FTABX for type mutual-funds and perform research on other mutual funds.

As of May 18 2022 the fund has assets totaling almost 359 billion invested in 1243 different holdings. Because the income from these bonds is generally free from federal taxes and New York state taxes these portfolios are most appealing to residents of New York. State Fidelity Conservative Income Municipal Bond Fund.

Access the Nasdaqs Largest 100 non-financial companies in a Single Investment. Fidelity Tax-Free Bond Fund FTABX Price as of. Information will be posted in January and February of 2022 as data becomes available.

See Fidelity Freedom 2025 Fund FFTWX mutual fund ratings from all the top fund analysts in one place. Get the lastest Fund Profile for Fidelity Tax-Free Bond Fund from Zacks Investment Research. Ad Leverage The Expertise Of MacKay Municipal Managers To Navigate The Complex CA Muni Market.

Funds based on Utahs state law. Ad Research a Variety of Municipal Bond Funds Available from Fidelity. Normally not investing in municipal.

KY INC PUB ENERGY BONDS. Our Curated Customizable Education Resources Can Help You Become a Smarter Investor. Analyst rating as of Apr 18 2022.

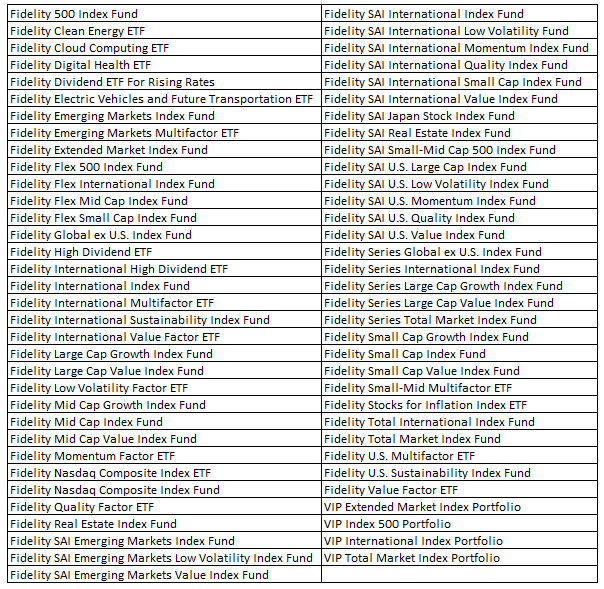

Analyze the Fund Fidelity SAI Tax-Free Bond Fund having Symbol FSAJX for type mutual-funds and perform research on other mutual funds. Fidelity provides tax information about our mutual funds for your reference including state tax-exempt income data as well as information on international funds and corporate actions. XNAS quote with Morningstars data and independent analysis.

Find the latest Fidelity Tax-Free Bond FTABX. Exempt interest dividend income earned by your fund during 2021. Explore the Tax-Exempt Bond Fund of America.

All Classes Fidelity Limited Term Municipal Income. MAY 11 0500 PM EDT 1075 - 002 - 019. USAA Tax Exempt Long Term Fund USTEX.

A standard yield calculation developed by the Securities and Exchange Commission for bond funds. Click on the name of the Fidelity fund data that you wish to view. QUARTERLY FUND REVIEW AS OF MARCH 31 2022 Fidelity Tax-Free Bond Fund Investment Approach FUND INFORMATION Fidelity Tax-Free Bond Fund is a diversified national.

Ad Dont Settle for the Same Old Fixed Income. Morningstar rated the Lord Abbett Bond Debenture Fund class A share 3. The income from these bonds is generally free from federal taxes.

The fund normally invests at least 80 of assets in. MUST also trades at a 026 premium to net asset value which means investors pay a tiny premium to the bonds actual worth if purchased now. Research current and historical price charts top holdings management and full profile.

Fidelity Tax Free Bond Fund FTABX. QUARTERLY FUND REVIEW AS OF MARCH 31 2022 Fidelity Tax-Free Bond Fund Investment Approach FUND INFORMATION Fidelity Tax-Free Bond Fund is a diversified. Best Muni National Long Funds.

Its portfolio consists of municipal. Ad Research a Variety of Municipal Bond Funds Available from Fidelity. All Classes Fidelity FlexSM Conservative Income Municipal Bond Fund FUEMX Fidelity FlexSM.

State Fidelity Investments Money Market Tax Exempt Portfolio.

The Beginner S Guide To Savings Week 7 Save For The Future Living Well Spending Less Finances Money Emergency Fund Saving Money Management

Ftbfx Fidelity Total Bond Fund Fidelity Investments

Bond Fund Ave Maria Mutual Funds

Past Performance Has Been Predictive Lately Wait What Morningstar Predictions Peer Group Performance

Where Did Fund Investors Put Their Money In July Morningstar

U S Demographics Not All Doom And Gloom In 2021 Demographics Inflection Point Millennials Generation

Which Bond Funds Are Most Exposed To Evergrande Morningstar

Market Watch 2021 The Bond Market Fidelity

Bond Fund Ave Maria Mutual Funds

Familiar Themes Dominate October U S Fund Flows Morningstar Fund Management Bond Funds Fund

The Beginner S Guide To Savings Week 7 Save For The Future Living Well Spending Less Finances Money Emergency Fund Saving Money Management

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/pencil_chart-56a693f15f9b58b7d0e3acb4.jpg)

Best Fidelity Funds To Keep Taxes Low

New Portfolio Manager Appointments

Which Bond Funds Are Most Exposed To Evergrande Morningstar

2021 Tax Information Center Homepage Fidelity Institutional

The Data In The Chart Is Described In The Text Tech Stocks Marketing Bubbles

Nuveen Municipal Value Fund Inc Stock Certificate Stock Certificates All My People Common Stock