massachusetts real estate tax rates

Real estate taxes are billed quarterly. In the Commonwealth of Massachusetts all real estate and personal property taxes are assessed on a fiscal year basis.

2019 Massachusetts Tax Rates For Real Estate Residential Property

For many cities and towns property taxes are the largest funding source for teachers police firefighters public works like trash pick-up.

. Economic Development Commission Facebook Page. If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. Adding 2021 Rates here.

Massachusetts Estate Tax Rates. 351 rows Map of 2022 Massachusetts Property Tax Rates - Compare lowest and highest MA property taxes for free. 2022 Massachusetts Property Tax Rates.

This report includes all local options except meals rooms short-term rentals and recreational. The table below lists all of the rates. However some counties charge additional transfer taxes.

The municipal tax rate for 2021 remains stable when compared to the previous year. 104 of home value. Provided for informational purposes only - please refer to massgov or each towns municipal website for most accurate tax rate.

They are expressed in dollars per 1000 of assessed value often referred to as mill. Tax amount varies by county. Also we have lots of historical tax rate information.

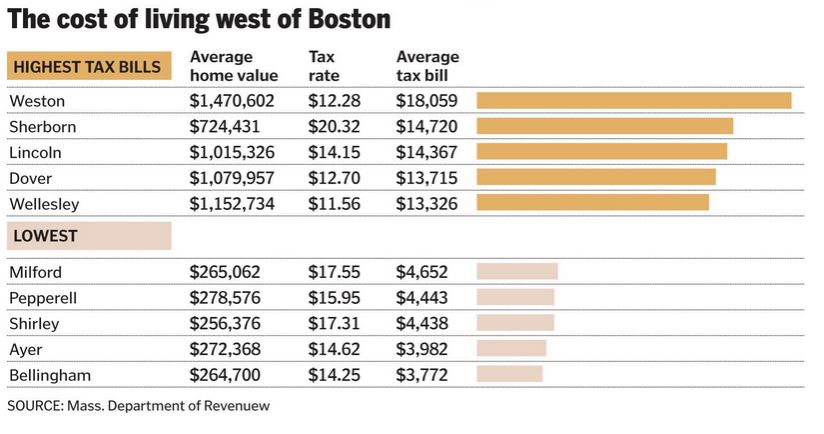

If youd like from Highest to lowest please click here. The state average is 1524 per 1000 of the assessed value of a home figures from the. To figure out how much your estate will need.

Local Options Adopted by Cities and Towns. 5083666848 Sign in to your. The estate tax rate for Massachusetts is graduated.

However reserved for the county are appraising property mailing levies bringing in the tax conducting compliance. Fiscal Year 2022 Tax Rates. Under Massachusetts law the government of your city public schools and thousands of other special purpose districts are given authority to evaluate real estate market value set tax rates.

The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000. The basic transfer tax rate in Massachusetts is 228 per 500 of property value. The fiscal year runs from July 1st through the following.

General Laws - Altering Land Bordering Waters. Massachusetts Property Tax Rates 2021 Residential and Commercial. Massachusetts Property Tax Rates.

Property Database and Field Cards. Massachusetts Municipal Property Taxes. Adopted Local Options Impacting Property Tax.

For example in Barnstable County. The tax rate for FY2020 is 1010 per thousand of assessed value. If youre responsible for the estate of someone who died you may need to file an estate tax return.

Here are links to 2019 2018 2017. Tax rates are approved annually by the Department of Revenue to ensure that municipalities have balanced budgets and tax levies within the limits set by Proposition 2. 370 rows Massachusetts Property Tax Rates by Town.

Current 2022 Tax Rates Per 1000 Property. Beverly sets tax levies all within Massachusetts regulatory directives. Real Estate Tax.

Here you will find helpful resources to property and various excise taxes administered by the Massachusetts Department of Revenue DOR andor your citytown. The yearly taxes are based on the fiscal year July 1st through June 30th. Tax rates in Massachusetts are determined by cities and towns.

Chilmark has the lowest property tax rate in Massachusetts with a tax rate of 282 while Longmeadow has the highest property tax rate in Massachusetts with a tax rate of 2464.

How Do State And Local Property Taxes Work Tax Policy Center

Town By Town Assessed Home Values And Billed Property Tax Amounts In Massachusetts From 2000 To 2010 Boston Com

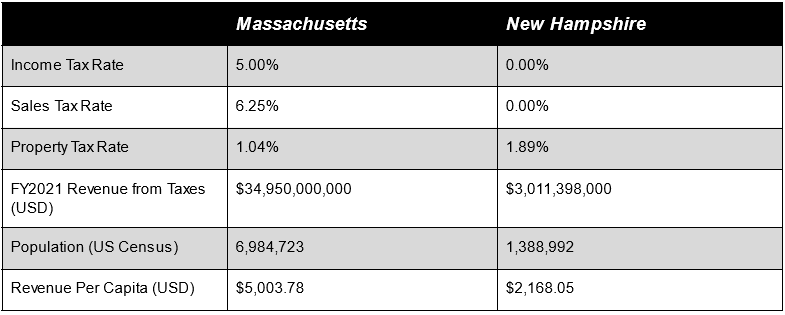

New Hampshire Tax Burden Dramatically Less Than Massachusetts Blog Transparency Latest News

Does Your State Have An Estate Or Inheritance Tax

2019 Residential Property Tax Rates For 351 Ma Communities Boston Ma Patch

Massachusetts Property Tax Rates Christine Mclellan William Raveis Real Estate

U S Cities With The Highest Property Taxes

Tangible Personal Property State Tangible Personal Property Taxes

U S Cities With The Highest Property Taxes

Low Property Taxes Top High School Make Franklin Stand Out 02038 Real Estate

Golocalworcester Ma Has 8th Highest Auto Taxes In U S

State Limits On Property Taxes Hamstring Local Services And Should Be Relaxed Or Repealed Center On Budget And Policy Priorities

Woburn Cuts Property Tax Rates Woburn Ma Patch

Massachusetts Property Tax Rates In 2018 Somerville Ma Patch

Massachusetts Property Tax Rate Per Town Or City 2019

Who Pays Massachusetts Real Estate Transfer Taxes Sapling

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation